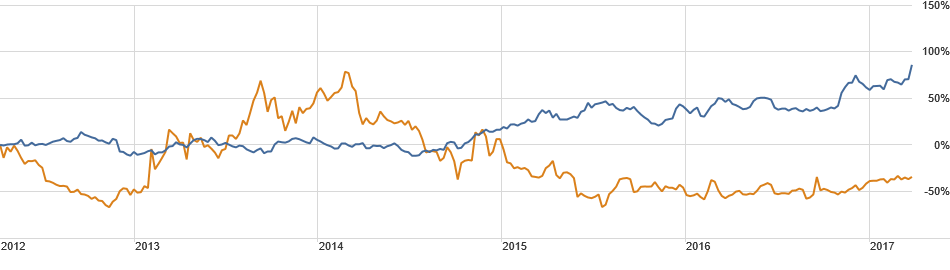

See for yourself: The blue line is Darden (DRI) and the gold line is Caesars (CZR).

Caesars Model: “Only Ideal Customers are Valuable”

- Customers are tiered into distinct groups by provable spend: Gold, Platinum, Diamond and 7 Stars

- Employees are instructed to drop whatever they’re doing to help a higher tier guest. By way of example, if a bellman is transporting bags for a Gold and a 7 Stars needs something, he’s supposed to stop what he’s doing and assist the 7 Stars guest, even if it means ignoring the original guest

- Golds are often assigned dank rooms with scratched furniture and dusty shelves. Diamond and 7 Stars guests get fresh rooms with desirable views

- Golds must pay up to $45 for valet service and their vehicles are the last to be called up. Diamond and 7 Star guests pay nothing and jump the line

Result: CEO who instituted these changes ousted; $30 bn in restructuring debt; decreasing market share; bankruptcy reorganization.

Seasons 52 Model: “All Customers are Valuable, Some More than Others”

- Customers are grouped in Darden’s proprietary software, known as DASH, but are not made aware of tier score, RFM or other metric through any distinct hierarchical plan

- Goal is to treat all customers like “Kings and Queens”

- All customers receive complimentary valet at most locations

- New customers receive complimentary dessert

- High value guests are provided visits by chefs and managers, including the Managing Partner of the subject restaurant, along with occasional comps

Result: Darden Signature Restaurant Group (SRG) highest growth segment of the company; 22.2% Growth in 2015; Average Restaurant Sales $5.5 million; DRI market cap roughly $8 bn; board declared regular monthly dividend.

There is nothing wrong with grouping customers per se, or with rewarding high value customers with additional benefits. The error comes from inverting the Service Profit Chain (ironically, a concept popularized by the deposed Caesars CEO). The level of service a customer receives and his ultimate profitability are inextricably linked. At Caesars, guests must prove their loyalty to receive good service. At Seasons 52, the restaurant proves it can provide good service and then asks for your loyalty.

This creates a funnel that constantly provides new high value guests, and makes fans out of first-timers. The Caesars Model is tilted toward rewarding longtime customers, but drives away new business and provides an extremely narrow pipeline to progress a guest along the value path, i.e. graduating a Gold to a Platinum or a Diamond).

The Caesars Model also fails to take the cost of failed opportunity into account. Often a guest who is unprofitable, and will likely remain that way, can drive away other potentially profitable guests through negative word of mouth, poor online reviews and challenging suggested visits to friends and colleagues.

Thus a customer with a LTV of $1000 can drive away $50,000 worth of business (see attached article).

Smart Targeting of ideal segments is essential, but we must be wary of inadvertently firing too many customers – lest they wind up firing us first.

Recent Comments